Finding a financial institution that genuinely understands your unique needs can feel a bit like searching for a hidden gem, can't it? For many connected to the federal government and those living in the Washington, D.C. area, the Department of Commerce Federal Credit Union, often called DOCFCU, stands out as a really solid choice. Established way back in 1964, this credit union has a long history of serving its community with a warm, helpful approach to banking, so it's almost a given that they know their stuff.

This isn't just any bank, you see. It's a member-focused credit union, meaning its goal is to serve its members well, not just make a profit. They've been headquartered in Washington, District of Columbia, for decades, and that local presence really helps them connect with the people they serve. Whether you're thinking about a big purchase, trying to save up, or just need to handle your everyday money matters, they offer a range of services designed to make your financial life simpler, which is pretty neat.

We're going to take a closer look at what makes the Department of Commerce Federal Credit Union a distinct and reliable option for your money. From their helpful staff to their various loan options and convenient online tools, there's quite a bit to explore. It's about finding a place where your savings are secure and where getting a loan feels straightforward, and that's exactly what we'll talk about today, you know?

Table of Contents

- About Department of Commerce Federal Credit Union (DOCFCU)

- Your Money is Safe: Federal Insurance

- Making Connections: Contacting DOCFCU

- Smart Financial Moves: Loans and Rates

- Growing Your Money: Savings and Certificates

- Banking on the Go: Online and Mobile Access

- Frequently Asked Questions About DOCFCU

- Why Consider Department of Commerce FCU?

About Department of Commerce Federal Credit Union (DOCFCU)

The Department of Commerce Federal Credit Union, or DOCFCU as it's often known, has been a steady presence in the Washington, D.C. community for a very long time. It was established in 1964, which means it has decades of experience helping people with their money. This credit union isn't just a building; it's a financial institution that serves all of Washington, D.C., with a particular focus on those connected to the federal government and its contractors. Their main goal, apparently, is to serve all their members well, making sure everyone feels supported in their financial journey, and that's a pretty good aim for a financial group, wouldn't you say?

They're headquartered right there in Washington, District of Columbia, making them a truly local institution with a deep understanding of the area's financial landscape. This local connection means they often have a better feel for what the community needs, which is a big plus. When you consider a financial partner, it's really helpful to know they've been around for a while and have a clear mission to put their members first, which DOCFCU certainly seems to do.

Your Money is Safe: Federal Insurance

One of the most important things to think about when choosing where to keep your money is how safe it is. With the Department of Commerce Federal Credit Union, you can rest easy knowing your savings are federally insured. This means your money is protected to at least $250,000, and that protection is backed by the full faith and credit of the United States government. It's a bit like having a very strong safety net under your funds, which is incredibly reassuring, especially these days.

This level of insurance is a standard for credit unions, and it really shows their commitment to keeping your deposits secure. So, when you put your hard-earned money into a savings account or a certificate at DOCFCU, you're not just hoping it's safe; you have a government guarantee. That kind of peace of mind is pretty valuable, and it's something they make sure to highlight, too.

Making Connections: Contacting DOCFCU

Reaching out to your financial institution should always be easy, shouldn't it? The Department of Commerce Federal Credit Union understands this, and they offer several straightforward ways to get in touch. Whether you prefer to talk on the phone, send an email, or even use traditional mail, they have options available. This accessibility is really important when you have questions about your account, need help with a loan, or just want some general information, and they seem to have thought of everything in that regard.

You can find the phone numbers and email addresses for their staff, which makes getting specific help a lot simpler. They also provide details on their branch hours, locations, and even their holiday schedule, so you can plan your visits without any guesswork. Knowing how to reach them quickly and efficiently is a big part of feeling comfortable with your bank, and DOCFCU makes sure that information is readily available, which is very helpful.

Staff and Leadership

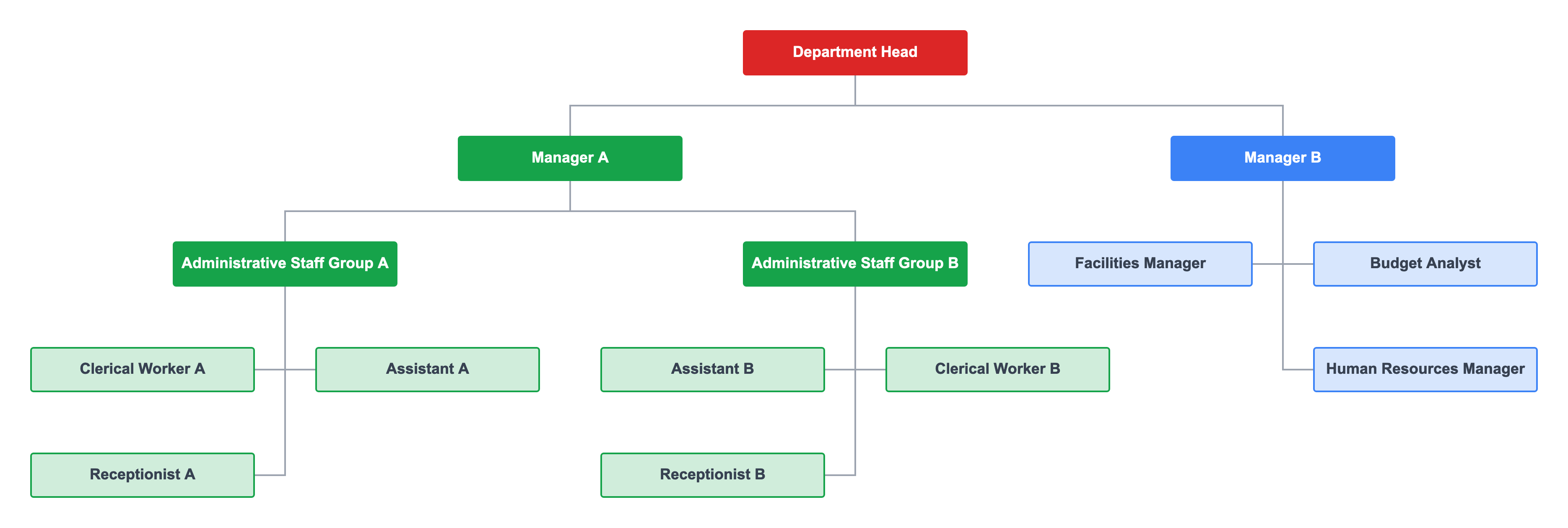

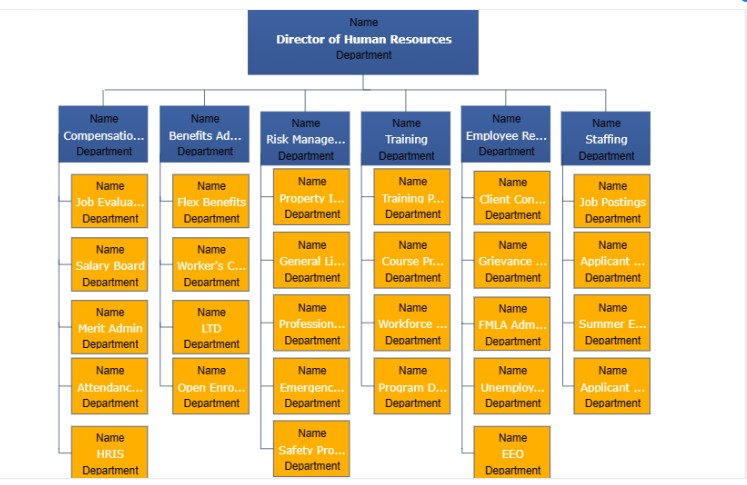

The people behind a financial institution really make a difference, and at the Department of Commerce Federal Credit Union, there's a dedicated team working to ensure smooth operations. You can actually find information about the chief executive officer and other staff members, sometimes even their educational backgrounds, like those who've studied at Georgetown University McDonough School of Business. This kind of transparency can help you feel more connected to the organization and the people guiding its direction.

The leadership team at DOCFCU has a big responsibility. They're in charge of setting the strategic direction for the credit union, making sure operations run efficiently, and maintaining financial stability. It's about making smart decisions that benefit all members, and they seem to take that role very seriously. Knowing there are experienced individuals at the helm can give you an extra layer of confidence in your financial partner, which is quite important.

Branches and Accessibility

Even in today's digital age, having physical locations where you can go for help or to conduct transactions is still really valuable for many people. The Department of Commerce Federal Credit Union has three branch locations, all serving the D.C. area. This means you have options for where you can visit in person, which is handy if you prefer face-to-face interactions or need to use an ATM.

Beyond the branches, they also provide information on ATM locations and their routing number (254074439) for online transactions. This commitment to both in-person and digital accessibility shows they understand different people have different banking preferences. It's about making banking easy wherever you are, whether that's online, on your mobile device, or by stepping into one of their welcoming branches, and they seem to cover all the bases, basically.

Smart Financial Moves: Loans and Rates

When it comes to making significant financial moves, like buying a car or a home, getting a good rate on a loan is often at the top of everyone's mind. The Department of Commerce Federal Credit Union understands this completely. They offer a range of financial services, and loans are a big part of that. They believe that a great rate isn't the only thing that makes for a smart financial decision, but it's definitely one of the most important things you should consider, and they work to provide competitive options.

You'll find all their current rates listed, which makes it simple to compare and see what works best for your situation. Whether you're looking for a personal loan, a way to finance a vehicle, or a mortgage, they aim to provide terms that are favorable to their members. It's about helping you achieve your goals without feeling overwhelmed by high costs, and that's a pretty comforting thought, isn't it?

Getting Around: Auto Loans

Dreaming of a new car, truck, or SUV? The Department of Commerce Federal Credit Union offers auto loans designed to help you get behind the wheel. They provide competitive rates and terms, which means you could potentially save money over the life of your loan. It's about making vehicle ownership more accessible and affordable for their members, which is a good thing for anyone looking to upgrade their ride.

They simplify the process of getting an auto loan, helping you understand the details so you can make a confident decision. Whether you're buying new or used, they aim to provide a smooth experience. This service is a key part of how they support the financial needs of the federal government community and the wider D.C. area, helping people make those important transportation purchases, you know?

Finding Your Home: Mortgage Solutions

Buying a home is one of life's biggest financial steps, and having a trustworthy lender by your side can make all the difference. DOCFCU Mortgage offers a variety of loan options for both home buyers and those looking to refinance their current homes in Washington, D.C. They lend to people nationwide, which is a pretty broad reach, showing their capacity to help many individuals find their perfect home.

You can learn more about the benefits, rates, and requirements of their different mortgage programs. They make it possible to get started online, or you can contact a loan advisor for personalized guidance. Whether you're a first-time buyer or looking to tap into your home equity, they have solutions like home equity loans and lines of credit. It's about finding a mortgage with a great rate from a lender you can trust, and they're ready to help you explore those possibilities, which is really what you want in a partner for such a big decision.

Other Lending Options

Beyond auto and home loans, the Department of Commerce Federal Credit Union also provides other lending solutions to meet various financial needs. While the provided text specifically highlights mortgages and auto loans, a comprehensive financial institution like DOCFCU typically offers a broader range of credit products. These might include personal loans for unexpected expenses or consolidating debt, and perhaps even lines of credit for flexible borrowing. Their focus is generally on providing competitive rates and terms across all their lending services, making it easier for members to manage their finances effectively, which is a pretty common goal for credit unions, isn't it?

They aim to be a one-stop shop for their members' borrowing needs, making the process as straightforward as possible. So, if you have a financial goal that requires a loan, it's a good idea to check with DOCFCU to see what options they have available. Their commitment to offering a variety of loan types means they're prepared to support different life events and financial situations, which is quite reassuring.

Growing Your Money: Savings and Certificates

Saving money is a fundamental part of financial well-being, and the Department of Commerce Federal Credit Union provides different ways to help your money grow. They offer various savings accounts, which are federally insured, as we discussed, giving you peace of mind. These accounts are designed to make it easy to put money aside for your future goals, whether that's a rainy day fund or a big purchase down the road, and that's a very sensible approach to money management.

In addition to regular savings, they also offer share certificates and savings certificates. These are similar to Certificates of Deposit (CDs) and typically offer higher interest rates in exchange for keeping your money deposited for a specific period. It's a way to earn more on your savings if you don't need immediate access to the funds. They provide all their current rates, allowing you to compare and choose the option that best fits your savings strategy. It's about helping your money work harder for you, which is always a good thing, basically.

Banking on the Go: Online and Mobile Access

In today's busy world, having easy access to your banking services wherever you are is incredibly convenient, isn't it? The Department of Commerce Federal Credit Union understands this need for flexibility. They offer robust online banking and mobile device access, allowing you to manage your finances without having to visit a branch in person. This means you can handle many of your banking tasks from the comfort of your home or while you're out and about, which is a huge time-saver.

Through their online platform, you can sign in to your account, enroll for online banking if you haven't already, and even reset your password if you forget it. It's designed to be user-friendly, giving you control over your accounts with just a few clicks or taps. This ease of access is a key benefit, allowing you to check balances, transfer funds, and pay bills on your schedule, making your financial life just a little bit simpler, which is what we all want, truly.

Frequently Asked Questions About DOCFCU

What services does Department of Commerce Federal Credit Union offer?

The Department of Commerce Federal Credit Union offers a broad range of financial services to its members. These services include various types of loans, such as competitive auto loans for cars, trucks, and SUVs, and a variety of mortgage options for home buyers and refinancers in Washington, D.C., and nationwide. They also provide different savings solutions, like regular savings accounts and share or savings certificates, designed to help your money grow. Furthermore, they offer convenient online banking and mobile access, allowing you to manage your accounts easily from almost anywhere, so it's a pretty comprehensive offering.

How can I contact Department of Commerce Federal Credit Union?

You can reach the Department of Commerce Federal Credit Union in several ways, making it quite convenient to get in touch. You can find their phone numbers and email addresses for staff on their website, allowing for direct communication. They also provide information on their branch locations, hours of operation, and holiday schedules for in-person visits. For online banking inquiries or support, you can access their sign-in portal, and they also list their routing number (254074439) for various transactions. It's about giving you multiple avenues to connect, which is very helpful, you know?

Is my money safe at Department of Commerce Federal Credit Union?

Yes, your money is very safe at the Department of Commerce Federal Credit Union. Your savings are federally insured to at least $250,000. This insurance is backed by the full faith and credit of the United States government, providing a strong layer of protection for your deposits. This means that even in unforeseen circumstances, your funds up to the insured amount are secure. This federal backing gives members significant peace of mind, which is a really important aspect of choosing a financial institution, isn't it?

Why Consider Department of Commerce FCU?

Thinking about your financial future means choosing partners you can really trust. The Department of Commerce Federal Credit Union, with its roots going back to 1964 and its strong focus on serving the federal government community and Washington, D.C., offers a compelling option. They're not just about transactions; they're about providing a place where your financial well-being is a genuine priority. From competitive rates on auto loans and mortgages to secure, federally insured savings, they cover a lot of ground.

Their commitment to accessible banking, whether through their friendly staff, convenient branch locations, or easy-to-use online and mobile tools, means managing your money can be simpler than you might expect. It's about having a financial partner that's been around for a while, understands your needs, and is ready to help you make smart money decisions. So, if you're looking for a credit union that combines a long history of service with modern banking conveniences, Department of Commerce Federal Credit Union is certainly worth exploring further. Learn more about their offerings on our site, and you might also want to check out their official website for the most current details, or perhaps even read some member testimonials there. You can find their official site by searching for "Department of Commerce Federal Credit Union official website" online.

- April 25th Miss Congeniality

- Koi Kawa Japanese Restaurant

- Back Brace For Posture

- Who Is Megan Moroney Dating

- Carolines Donuts

Author Details:

- Name : Prof. Chesley Little MD

- Username : tony69

- Email : boyle.jacynthe@rowe.net

- Birthdate : 2006-12-12

- Address : 316 Imani Branch Apt. 452 Madonnafort, AK 21239-9210

- Phone : 1-220-742-9443

- Company : Marvin LLC

- Job : Administrative Services Manager

- Bio : Quo nesciunt ullam natus. Tempore culpa voluptas et dolores dolorem aliquid. Ut quae dignissimos blanditiis consequatur dolore.

Social Networks

Twitter:

- Url : https://twitter.com/crunte

- Username : crunte

- Bio : Possimus reiciendis sit laboriosam dolor. Modi delectus impedit qui. Ullam quae omnis ullam necessitatibus et quos.

- Followers : 5454

- Following : 2719

Facebook:

- Url : https://facebook.com/caroline.runte

- Username : caroline.runte

- Bio : Sed odit eaque quaerat repudiandae deserunt.

- Followers : 387

- Following : 1101